Q: Should I use revenue and churn alone to calculate LTV, or should I also consider COGS and the time value of money?

A: The answer is that you should consider COGS and the time value of money (discounting at your cost of capital), and the other marginal costs of servicing and retaining a customer. Few companies do all of the above.

LTV as it is often calculated, skews more as a vanity metric than one that reflects real managerial accounting or fully discounted economic value. Most companies do the following to calculate their customer LTV:

So, for example, if the ARPC of our MidChurn example company is $10k, and the churn is 10%, then the average customer lifetime is 1/10% = 10 years, and the customer lifetime value is therefore calculated as 10 years X $10k / year = $100k.

Further, if we calculate the average Customer Acquisition Cost (CAC) (not CAC delineated by segment, cohort, nor marketing channel, but just average CAC), is $50k / customer, then all appears absolutely fantastic: we acquire customers for 50% of what they are worth to us, and we should be spending up to 70 or 80% of our calculated LTV on new customer acquisition, all day long. So applying this logic, we are actually underspending on CAC relative to what makes economic sense.

But this approach is flawed, and in at least two major ways:

First, back to accounting 101, the real value of a customer is not measured by the revenue they drive, but rather the contribution margin they add, net of cost of goods sold (COGS). Furthermore, the real contribution to the bottom line, on an incremental basis, must also include expenses like customer success and support hours (and renewal admin, and some amount of R&D to keep the product fresh and relevant), which are often missed when burdening SaaS COGS (which often include only infrastructure and hosting costs, and don’t account for the other post-sales support resources that are necessary to retain customers and are therefore representative of the true ongoing COGS).

There’s more – the other miss here is that the value of dollars earned in the out years must be discounted at what is called the weighted average cost of capital, or WACC. In most growth stage SaaS businesses, one can comfortably use a figure of at least 20% as representative of the cost of capital (if the company has access to venture or mezzanine debt for growth), but is closer to 30% for any outside growth equity investor, taking their target internal rate of return (IRR) target as a proxy.

Calculating Your True LTV

Set against the backdrop of these facts, what is the real LTV of MidChurn? Well, without getting into the details of what goes into the various COGS and non-COGS expenses (the subject of future article), let’s assume that their income statement COGS is 30% of revenue, yielding a 70% gross margin. Further, let’s assume that another 10% can fairly be attributed to other SG&A costs, on an incremental basis. So, the real incremental contribution of each dollar of recurring revenue is 60%, or 60 cents. Finally, let’s take the lower end of the 20 – 30% range as the WACC for MidChurn, presumably because they are at sufficient size and scale to attract somewhat less expensive money.

The following table sets forth the real, discounted, annual incremental contribution dollar value, for the 10 year expected lifetime of the customer:

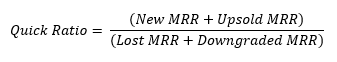

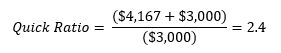

Another way to express this in a formula is:

Why is LTV important?

If the CAC of $50k prevails as accurate, then the customer that we thought was worth $100k, is worth just $25k.

What’s worse, we are literally losing $25k of economic value (spending $50k to extract $25k), for each customer that we acquire. MidChurn Inc is a money losing machine.

To right this particular ship, we would need to reduce CAC to at most 70 or 80% of the LTV, or let’s say $20k. And even then the CAC recovery time (the subject of a future article), would be 3.3 years, when a ‘healthy’ SaaS business should be aiming to fully recover CAC within 12 – 18 months at the most.

Curious to know how your real LTV stacks up?

Only your data can accurately answer this question. Please input your numbers into the calculator below, or get in touch to us to get further input on your metrics.