Q: What’s more important as a determinant of financial value: growth or churn?

A: Probably the most common single question we get – and the Quick answer is the Quick Ratio, which accommodates both.

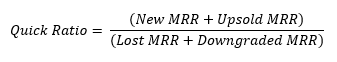

The Quick Ratio is the ratio between New/Upsold MRR and Lost (churned)/Downgraded MRR:

Let’s take a simple example of an early stage SaaS growth business (HighChurn Inc.) with an SMB focus, currently running @ $1.2M ARR ($100k MRR) and aiming to grow 50% heading into a new calendar/fiscal year.

To achieve this, they must add 50% x $1.2M = $600,000 of net new annually recurring revenue (ARR) over the course of the calendar 12 months.

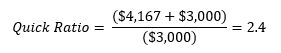

Assuming no churn, the company would need to add $600k / 12 months = $50k of total new MRR (or $4,167 new MRR per month) to be on track to hit their growth target.

However, as an SMB focused offering with a typical 3% gross monthly churn (~31% annual churn), they will lose 3% x $100k = $3,000 of MRR in January of our example year, and so will need to add an additional $3,000 of new revenue to make up for that and stay on pace for their growth target for the year.

So, they will need to acquire or upsell a total of $4,167 + $3,000 = $7,167 of new MRR in January.

About 40% of their customer acquisition effort (and CAC) is committed to replacing lost revenue, and 60% goes towards acquiring new customers or upselling existing ones.

The quick ratio here is $7,167 / $3,000 = 2.4, and is only marginally above the minimum accepted healthy figure of 2.0, existing in a range where churn is clearly hurting growth prospects.

Quick Ratio In A Lower-Churn Market

How would these numbers differ if we were talking about MidChurn Inc., focused on the lower churning mid-market, where typical annualized churn is on the order of 10%? Let’s do the math: 10% annual churn implies just 0.9% monthly churn, ignoring up-sales and downgrades. MidChurn’s loss on a $100k MRR base is just $874 in a month.

Now, MidChurn can achieve the same growth target with just $4,167 + $874 = $5,041 of new customer acquisition in January.

And the Quick ratio? It’s $5,041 / $874 = 5.8, well above the ‘magic number’ of 4.0.

How much more quickly would MidChurn be growing if they achieved the same gross customer acquisition figure as HighChurn of $7,167 of MRR? MidChurn would add net $7,167 - $874 = $6,293 of new MRR in January, and would keep that growth up through the remainder of the year, ending up with 76% annualized growth, not having spent a single dollar more on customer acquisition (we are holding CAC constant, here).

Finally, how much would HighChurn need to add in new MRR in order to achieve the same 5.8 quick ratio that MidChurn sports? The answer: 5.8 X the $3,000 churned MRR = $17,299 new MRR each month.

That implies $17,299 - $3,000k = $14,299 of net new MRR monthly, $171,593 annually, for a 172% growth rate!

As you can see, it’s difficult for a high churning company to have both a healthy Quick Ratio and a realistic growth rate; it’s much more realistic – in terms of the raw volume of necessary customer acquisition – to achieve 50 – 100% annualized growth when your annualized churn is kept in the low double digits.

Stay tuned for future posts in this series, covering subjects like cohort and segment analysis, CAC recovery time, LTV:CAC ratios, whether or not to use gross margin or revenue in LTV calculations, and whether or not you should be discounting your LTV dollars in the out years of customer lifetime (and the resulting implications for real Life Time Value).

What Is Your Ideal Quick Ratio?

Only your data can answer this question. Please try our interactive Quick Ratio calculator, below. If you'd like to discuss your numbers and their implications further, please submit your email and we will reach out to discuss. Alternatively, please contact us directly.