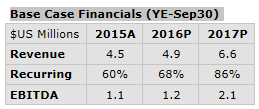

This table succinctly conveys 3 things: 1) the overall size of the company, 2) the growth rate of the company, and 3) the profitability of the company. We can see from the figures that this target will be small for many PE firms, particularly those that have a minimum 'bite size' in excess of $10M USD (on the basis they are unlikely to pay 9X trailing EBITDA for a relatively low growth business). We do highlight 3 additional points: 1) that the business has achieved consistent, steady growth, 2) that the churn rate (rate of customer loss) is exceptionally low, and 3) that the business is profitable and enjoys positive operating leverage (the EBITDA margin is set to grow with revenue, as significant fixed costs prevail). At this point, many PE or strategic buyers will stop reading because the target self-excludes for a poor match relative to size and/or growth, or industry focus.

Next, we summarize our arguments for growth:

Growth Drivers

» On-premise customers moving to SaaS licensing

» Increased Canadian sales penetration outside HQ province

» Provide full payroll remittance services

» Expansion into U.S. or European markets

These are the foundational, stand-alone growth levers discussed in Part 2 of this series, listed in order of opportunity. In this case, the move from traditional on-premises licensing plus annual maintenance to full SaaS, and the success-to-date transitioning existing customers, represented by far the largest active growth lever. The next most obvious was the opportunity to increase sales penetration outside the home province; the penetration rate in other English speaking provinces was only 25% as high as in their home province, where their only salesperson was domiciled. Although a feature commonly offered by competitors, our client's business did not handle the direct remittance of government deductions due to trust account and fund handling liability concerns, which sometimes cost them deals. We assessed this to be a relatively straightforward opportunity to grow the customer base. Finally, we highlighted the opportunity to move outside Canada; we listed this opportunity last, because we recognized that payroll doesn't travel across jurisdictions well (the nuances vary too much, geography to geography), and because only a US payroll engine had been seriously assessed for integration by the team.

We describe the product modules as follows:

Modules

» Payroll & Benefits Administration

» Human Resources & Recruiting Management

» Time & Attendance

» Employee / Manager Web Self Service Portal (w/ iOS and Android mobile apps)

In the context of HCM / HRIS, payroll is easily understood. For a mid-market focused player like our client, there are other clear and complementary modules required by nearly every customer. And mobile is always key. We list those, here.

Finally, we provide a snapshot of the technology stack:

Technology

» 100% company owned intellectual property

» Built on Microsoft stack (.NET/SQL)

» On-premise and SaaS versions

» Moving hosting to Microsoft Azure

» Modular design – individual modules can complement existing software

» Readily extended with tax/form engines to deliver payroll in other countries

We make the baseline and key assertion that there exists no reliance on outside, 3rd parties. We describe the base technology stack and technology choices, and discuss the extensibility of the platform.

A compelling Teaser that succinctly paints a picture of the target, and shines light on the potential for growth, is critical in the initial marketing of a private company for sale. If it's off key or poorly composed, response rates will suffer, and potential buyers may be lost. Post NDA, interested parties receive a full CIM and financial model, and are then offered a management meeting to dive in deeper and learn more.